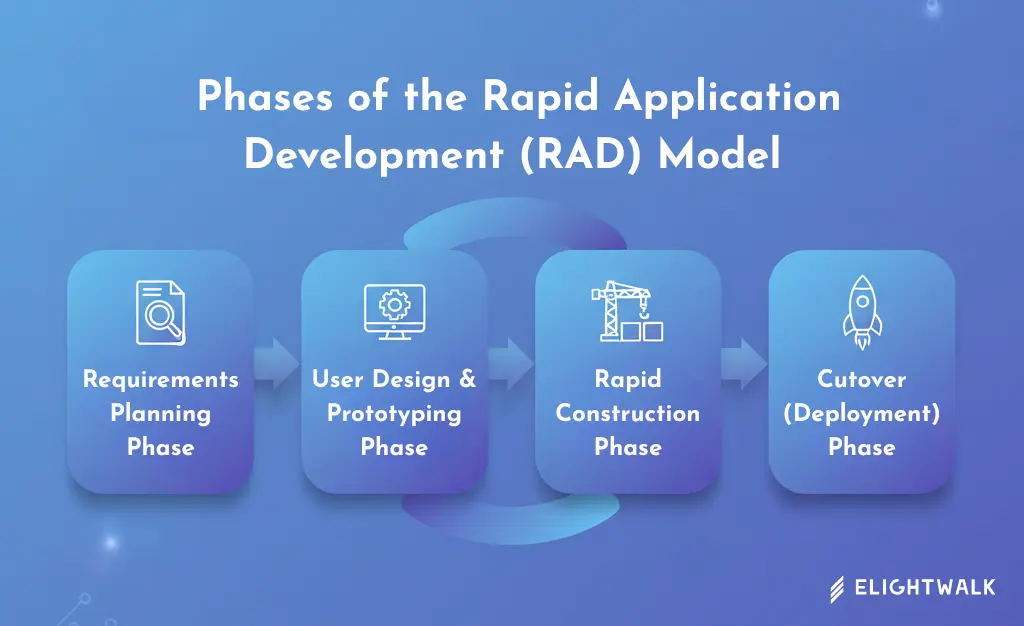

The FinTech industry is advancing at remarkable speed, driven by innovations in digital payments, regulatory technology, online lending, automation, and mobile banking. In this fast-paced environment, companies must innovate rapidly while ensuring accuracy, compliance, and security. The Rapid Application Development (RAD) model has become a powerful approach for FinTech teams seeking to deliver high-quality applications quickly without compromising user experience or regulatory requirements.

Why FinTech Needs RAD

FinTech products operate in extremely dynamic conditions, where customer expectations, market trends, and regulatory frameworks evolve constantly. RAD supports this environment through rapid development, continuous stakeholder collaboration, and iterative refinement.

1. Faster Product Innovation

Digital wallets, payment gateways, lending portals, and KYC dashboards require constant updates. RAD enables teams to quickly develop new features, gather real-user feedback, and iterate in short cycles. This agility keeps FinTech companies ahead of competitors and aligned with market trends.

2. Changing Regulatory and Compliance Requirements

FinTech platforms must meet strict and evolving regulations such as KYC, AML, PCI-DSS, GDPR, and regional compliance standards. RAD’s iterative process allows teams to update workflows, forms, and validation logic quickly without slowing down development, ensuring continuous compliance.

3. Need for Quick User Feedback Cycles

Users expect seamless onboarding, instant transactions, and intuitive digital experiences. RAD provides early-stage prototypes for user testing, enabling teams to address usability issues quickly, improve UX, and boost adoption rates.

4. Frequent Feature Updates Driven by Competition

FinTech companies regularly roll out features such as biometric login, instant transfers, AI-driven insights, and automated savings tools. RAD supports fast implementation of these updates, helping companies maintain a competitive edge and respond to customer demands rapidly.

How RAD Improves FinTech Development

Beyond speed, RAD enhances flexibility, user experience, and long-term maintainability—key attributes of successful financial software.

1. Rapid Prototyping for User-Centric Banking Apps

Interactive prototypes of banking interfaces, transaction flows, dashboards, and onboarding forms allow stakeholders to visualize the product early. This leads to better design decisions, reduced rework, and products that truly align with user expectations.

2. Modular Development for Payment Gateways, Wallets, and Dashboards

FinTech systems are naturally modular—authentication, payments, fraud detection, account management, and reporting. RAD leverages component-based development, enabling teams to reuse modules, integrate them easily, and update features independently.

3. Reduced Time to Launch New Digital Financial Products

For micro-lending platforms, BNPL services, neobank features, or investment apps, RAD drastically shortens time-to-market. By focusing on prototypes instead of heavy documentation, teams can validate assumptions early and release new financial products faster.

4. Faster Turnaround for Bug Fixes and Security Updates

Security and compliance are essential in FinTech. RAD’s iterative cycles allow early issue detection and rapid updates, helping teams patch vulnerabilities, optimize workflows, and stabilize systems without long release delays.

Use Cases of RAD in FinTech

RAD’s iterative model, modular architecture, and user-driven focus make it ideal for a variety of FinTech applications.

1. Loan Origination Platforms

Loan workflows—including application submission, identity verification, credit scoring, underwriting, and approval—benefit from RAD’s rapid prototyping. Teams can validate each step with users and compliance officers, ensuring accuracy and regulatory alignment.

2. Mobile Banking Apps

Mobile banking requires flawless UX, real-time performance, and ongoing feature updates. RAD supports rapid UI/UX design, incorporation of user-requested features, and quick delivery of improvements such as budgeting tools, insights, and secure authentication methods.

3. Fraud Detection Dashboards

Fraud detection systems need dynamic dashboards, anomaly alerts, and real-time risk scoring. RAD enables fast prototyping of dashboards, incorporation of feedback from analysts, and integration of machine learning models for enhanced monitoring.

4. Automated KYC/AML Workflows

KYC and AML processes change frequently due to compliance updates. RAD allows rapid development of identity verification, document scanning, risk profiling, audit trails, and rule-based workflows—ensuring minimal disruption to existing systems.

RAD’s speed, flexibility, and collaborative approach make it one of the most effective development methodologies for FinTech innovations. It enables companies to deliver secure, compliant, high-performance financial products at a pace that matches today's fast-moving digital economy.